san francisco payroll tax and gross receipts

From imposing a single payroll tax to adding a gross receipts tax on various real estate entities including commercial rentals and gathering funds to assist the homeless population. What is San Francisco income tax.

Cashier S Check Examples Examples Of Cashier S Check Examples10 Com Cashier S Check Money Template Templates Printable Free

The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6 2012.

. Stop overpaying taxes by collecting employees out-of-city time. Due to all the changes many business owners are confused. To avoid late penaltiesfees the return must be submitted and paid on or before the last.

Who pays Gross Receipts Tax in San Francisco. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. Brian Kirkell Pat Carney.

San francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the city. Businesses with more then 1 Million in Gross Receipts need to pay taxes to San Francisco. In November of 2020 San Francisco voted to increase Gross Receipt Tax rates in a shift to do away with the payroll tax and slowly increase GRT by 40 in all industries up to 104 for some categories.

The current due date for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement is February 28. 150 The city of San Francisco levies a 150 gross receipts tax on the payroll expenses of large businesses. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Mar 31Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health Fire Department Police Department and Entertainment Commission. To avoid late penaltiesfees the returns must be submitted and paid on or before April 30 2021. This is an action for declaratory relief and for the recovery of gross receipts and payroll expense taxes which were assessed against plaintiff Western States Bankcard Association WSBA by the City and County of San Francisco and paid under protest for the years 1970 through 1972.

6 the passage of proposition f fully repeals the citys payroll expense tax. In November 2012 San Francisco voters approved Proposition E phasing in a new gross receipts tax and phasing out the citys payroll expense tax over a five-year period starting on Jan. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses.

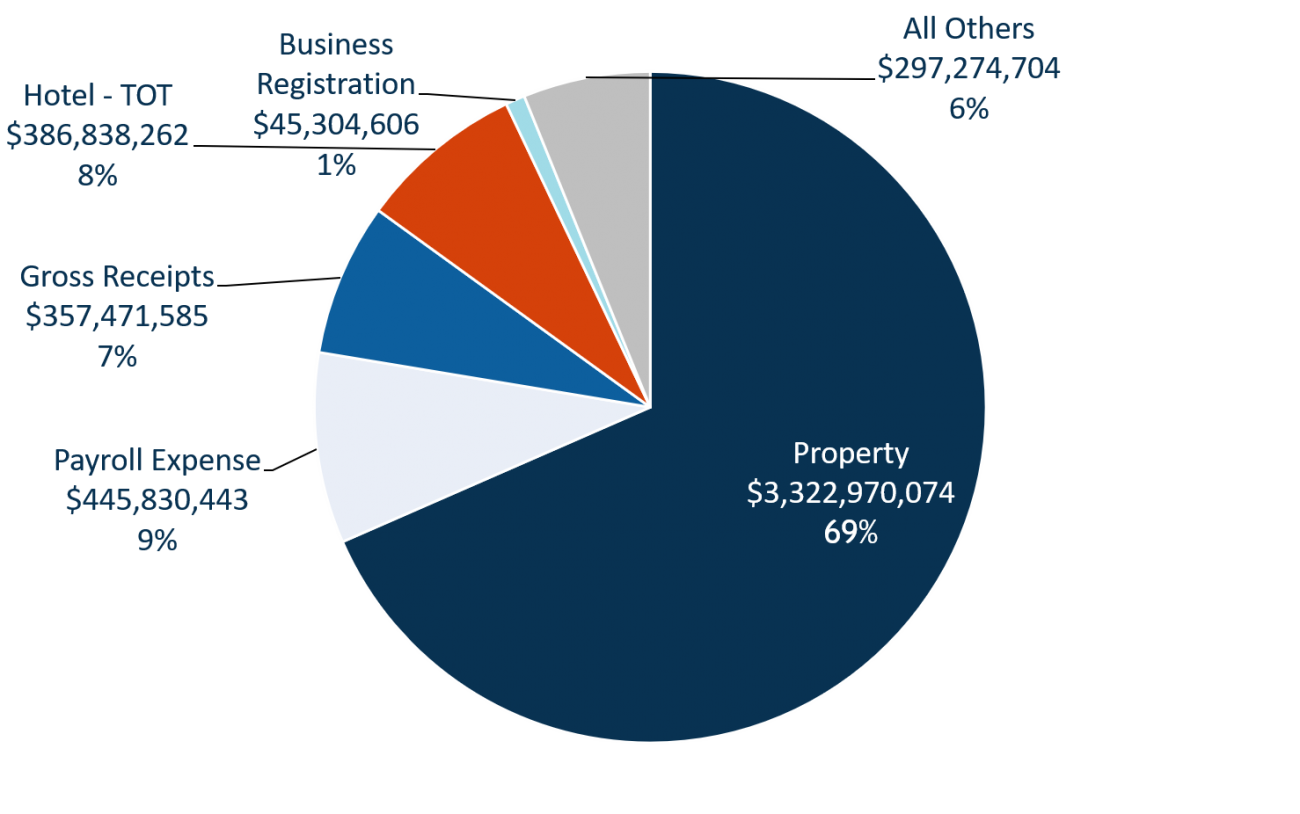

Gross receipts tax gr proposition f was approved by san francisco voters on november 2 2020 and became effective january 1 2021. Annual Business Tax Returns 2021 The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. 030821 Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

Feb 28Payroll Expense Tax and Gross Receipts Tax returns due. Beginning in 2014 the calculation of the sf payroll tax changes in two significant ways. Apr 30Commuter Benefits Ordinance Annual Compliance Form due.

However because the last day of February falls on a weekend this year the deadline has been extended to Monday March 2. For businesses engaged in retail trade wholesale trade and certain services the registration fee is 43 for businesses with less than 100000 in gross receipts which increases to 34510 for businesses with more than 200 million gross receipts. Beginning in tax year 2019 the Return will also include the Early Care and Education Commercial Rents Tax and Homelessness Gross Receipts Tax.

The new highest fee is 40261 for businesses with more than 200 million in gross receipts. How do the tax authorities determine gross receipts earned in. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes.

Although this is sometimes conflated as a personal income tax rate the city only levies this tax on businessesIncome Tax Brackets. The Homelessness Gross Receipts Tax imposes an additional tax on most entities with gross annual San Francisco receipts of over 50 million. Entities currently paying a payroll tax under the alternative administrative office taxing regime also are subject to an additional payroll tax of 15.

1 2014 and ending with 100 percent gross receipts tax for tax year 2018. San Franciscos Gross Receipts Tax GRT is calculated based on individual employees time spent in SF. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. Watch our instructional videos on filing your 2021 Annual Business Tax. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan.

1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax component and an increasing gross receipts tax component and 2 the tax is due in quarterly installments instead of bi-annual installments with the first. In its first year 2014 the Gross Receipts Tax is imposed at 10 percent of the rates approved by the voters while the Payroll Expense Tax remains at 90 percent of the rate applicable in prior years. City and County of San Francisco.

Apr 1Vessel Property Statements due. San francisco Gross Receipts. San francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the city.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. File Annual Business Tax Returns 2020 Instructions. San Francisco Payroll Tax.

5 the current payroll expense tax was originally set to phase out ratably between 2014 and 2018 but was postponed by the city in 2018. 50 less time in the city may mean a 50 reduction in tax owed. The due date for the gross receipts tax and payroll expense tax report and final.

Gross Receipts Tax rates are intended to gradually increase over the subsequent four years as the Payroll Expense Tax rate decreases. Businesses with more than 260000 in San Francisco payroll need to pay taxes to San Francisco. The Ordinance replaces the existing payroll expense tax on the privilege of doing business in San Francisco with a tax that is based on gross receipts from business conducted within the city.

To avoid late penaltiesfees the returns must be submitted and paid on or before February 28 2022. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. San Francisco Homelessness Gross Receipts Tax.

The San Francisco Annual Business Tax Return Return includes the Gross Receipts Tax Payroll Expense Tax and Administrative Office Tax.

2 Trillion Stimulus Deal Reached 19 Things You Need To Know About Your Check Money Template Ways To Get Money Payroll Template

Gross Receipts Tax And Payroll Expense Tax Sfgov

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

About Us Treasurer Tax Collector

San Francisco Gross Receipts Tax

Download Cash Book Excel Template Exceldatapro Excel Templates Bookkeeping Templates Excel Shortcuts

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

Template Design Store Driver License Passport Utility Bill Psd Template Id Card Template Drivers License Card Template

Amex Air Miles Gold Card Statement Psd Template High Quality Template Credit Card Statement Psd Templates Statement Template

Annual Business Tax Returns 2020 Treasurer Tax Collector

Due Dates For San Francisco Gross Receipts Tax

Annual Business Tax Return Treasurer Tax Collector

Kansas Driver License Psd Template Idqueen Id Card Template Drivers License Card Template